You can feel it in almost every audit right now: brands are buying traffic, but their site experience is doing “silent damage.” The product page looks fine, the ads look fine, and yet conversion rate stalls, refunds creep up, and CAC feels heavier than it did last year. That’s why ecommerce trends 2026 isn’t just a listicle topic—2026 is shaping up to be a year where the winners treat commerce like a system: content + checkout + post-purchase + measurement, all connected.

What’s changing is not one “new channel.” It’s the combination: shoppers expect AI help, social is turning into checkout, retail media is eating budgets, returns are becoming a profit line item, and privacy rules keep tightening. If you’re running Shopify, WooCommerce, or a custom stack, the good news is you can act on this fast—if you measure the right behaviors and fix the right friction.

How These Ecommerce Trends Were Selected (2026-Ready Method)

I pulled fresh 2025–2026 sources via Google, prioritized primary research and reputable industry forecasts, and filtered out hype that doesn’t show up in real store metrics. The rule was simple: each trend had to be (1) already being adopted by real retailers, (2) likely to impact revenue, conversion rate, AOV, or retention in 2026, and (3) supported by a recent report, forecast, or platform signal. When sources disagreed, I leaned toward the ones with clear methodology and measurable implications for ecommerce operators.

The 10 Ecommerce Trends for 2026

Ecommerce Trend 1: “Agentic” Shopping Moves From Novelty To Real Orders

What it is: AI is shifting from “help me research” to “help me buy.” Think assistants that compare options, build carts, and complete purchases inside controlled rules.

Why it matters in 2026: Your product data quality becomes a conversion lever. If your titles, attributes, shipping promises, and returns terms are messy, the “agent” will route the shopper elsewhere.

Proof point: Global Payments explicitly calls out “AI is your shopping agent” and “agentic commerce taking shape” (Press release, Dec 2025). EMARKETER’s AI commerce coverage also points to meaningful AI-driven ecommerce sales in 2026 (Report page, Jan 2026).

What I’d Do This Week:

- Audit product titles and attributes for consistency (size, materials, compatibility, bundle logic).

- Clean up shipping/returns promises so they’re unambiguous on PDP and in checkout.

- Improve structured on-site search: synonyms, filters that match how people shop, and “no results” recovery.

- Create 3–5 “decision pages” (comparison, best-for, buying guide) to feed both humans and AI assistants.

Watch-Out: Don’t confuse “AI chat on the site” with agent-ready commerce. If the underlying catalog, policies, and inventory signals are unreliable, AI just accelerates disappointment.

Ecommerce Trend 2: Personalization Gets Less “Cute” And More Profit-Driven

What it is: Personalization in 2026 is less about flashy widgets and more about relevance: merchandising, recommendations, and messaging that reduce choice overload and friction.

Why it matters in 2026: With rising acquisition costs, your fastest growth lever is often improving conversion rate and repeat purchase. Personalization is basically “CRO with context.”

Proof point: Deloitte flags AI moving from experimentation to execution and reshaping marketing and customer experience (Report, Jan 2026). NRF also highlights AI’s growing impact across retail going into 2026 (Article, Jan 2026).

What I’d Do This Week:

- Personalize the “next step,” not the whole site: PDP recommendations, cart add-ons, post-purchase offers.

- Segment by intent: new vs returning, category explorers vs direct-search shoppers, high-AOV vs low-AOV.

- Run one clean test: personalized PDP modules vs control, measured by CR and AOV (not clicks).

- Align email/SMS with on-site behavior (browse abandon, cart abandon, back-in-stock).

Watch-Out: Over-personalization can break trust. If it feels “creepy” or inconsistent across devices, shoppers bounce.

Ecommerce Trend 3: Social Commerce Stops Being “Top Funnel”

What it is: Platforms are compressing discovery and purchase into a single flow—especially through creator-led formats and native checkout experiences.

Why it matters in 2026: The creative becomes the landing page. Your PDP still matters, but the platform experience is now part of the conversion path.

Proof point: Retail Dive reports TikTok Shop momentum and cites forecasts that TikTok Shop sales will exceed $20B in 2026 (Article, Dec 2025). EMARKETER also projects TikTok Shop’s US ecommerce sales at $23.41B in 2026 (Article, Dec 2025).

What I’d Do This Week:

- Pick 5 products that “sell on demonstration” and build creator-ready scripts and hooks.

- Align PDP to social intent: short benefits, proof, shipping clarity, and fast variant selection.

- Track new-to-file rate and refund rate by social source (don’t just watch ROAS).

- Create a “social-proof bundle” (starter kits, creator picks) to lift AOV.

Watch-Out: Social commerce can spike returns if expectations aren’t managed. If you oversell in video, you’ll pay for it in reverse logistics.

I keep seeing a pattern: the brands that win at social in 2026 treat it like a product channel, not just an ad channel. They design the whole journey end-to-end—content, offer, checkout, and post-purchase—because that’s where ecommerce trends 2026 is heading.

Ecommerce Trend 4: Retail Media Networks Keep Pulling Budget From “Everything Else”

What it is: Retailers’ ad networks (on-site, off-site, and increasingly CTV) keep growing because they’re powered by first-party purchase data and closed-loop measurement.

Why it matters in 2026: If you sell on marketplaces or large retail sites, retail media is no longer optional. For DTC brands, it also changes how you think about incrementality and attribution benchmarks.

Proof point: EMARKETER forecasts US retail media ad spending growing from $60.32B in 2025 to $71.09B in 2026 (Article, Jan 2026).

What I’d Do This Week:

- Separate “defense” (branded search + category capture) from “growth” (new audiences) budgets.

- Demand measurement clarity: attribution windows, placement reporting, and incrementality options.

- Build retail-media-ready creative: product-first, benefit-first, simple offers.

- Sync inventory and promo calendars so ads don’t send traffic to out-of-stock products.

Watch-Out: Closed-loop doesn’t automatically mean “incremental.” If you don’t test lift, you can end up paying to re-buy customers who were already going to purchase.

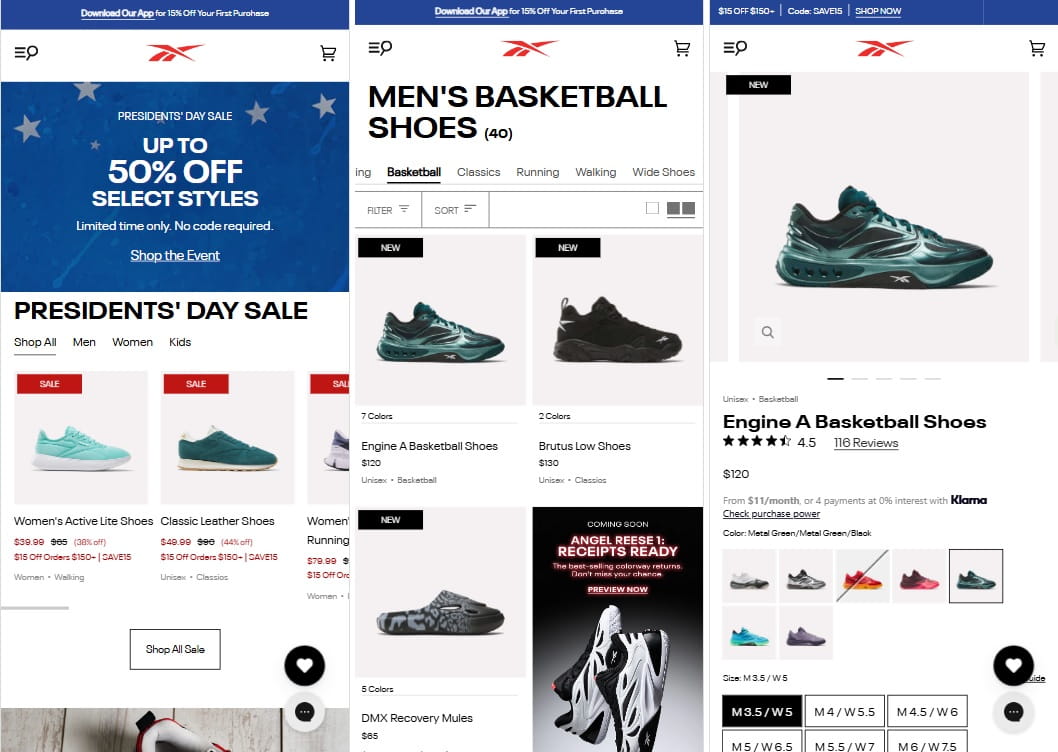

Ecommerce Trend 5: Checkout Simplification Becomes A Competitive Weapon

What it is: Fewer steps, fewer surprises, more payment flexibility, and more clarity on shipping/returns—especially on mobile.

Why it matters in 2026: Checkout is where “marketing promises” meet reality. Any friction here turns paid traffic into expensive bounces.

Proof point: Baymard’s ongoing research puts the average cart abandonment rate around 70% (Research page, updated view). Their cart abandonment list also compiles measured abandonment rates from multiple studies (Page updated Sep 2025).

What I’d Do This Week:

- Remove non-essential checkout fields; move optional data collection post-purchase.

- Show total cost earlier (shipping, taxes, fees) to avoid late-stage shock.

- Offer the payment methods your customers actually use (wallets, BNPL where appropriate).

- Run a “mobile thumb audit”: can a shopper complete checkout one-handed without misclicks?

Watch-Out: Don’t “optimize” by hiding critical info (delivery timelines, return rules). Short-term CR lifts can become long-term refund spikes.

Ecommerce Trend 6: Returns Become A Managed System, Not A Necessary Evil

What it is: Returns management turns into a strategic capability: policy design, fraud prevention, faster restocking, and retention-driven exchanges.

Why it matters in 2026: Returns hit margin twice—once on logistics and once on inventory velocity. If you can turn returns into exchanges and repeat purchases, you protect profit.

Proof point: EMARKETER expects online return volumes to rise to nearly $379B in 2026 (Article, Jan 2026).

What I’d Do This Week:

- Tag return reasons to specific PDP issues (size guidance, material clarity, imagery mismatch).

- Offer exchange-first flows and smart incentives (swap for store credit with a small bonus).

- Identify “high-risk SKUs” and improve sizing/fit content and FAQs on PDP.

- Monitor refund rate by acquisition channel (social often behaves differently than search/email).

Watch-Out: Tightening returns too aggressively can backfire. Customers will simply buy from the competitor with clearer, fairer policies.

Ecommerce Trend 7: Value-Seeking Shoppers Stay In Control (And They’re Not Shy About It)

What it is: “Value” isn’t only discounting. It’s clarity, predictable total cost, and trustworthy product quality signals—especially when budgets feel tight.

Why it matters in 2026: If your value story is unclear, you’ll pay more to acquire customers and you’ll lose more of them at checkout.

Proof point: Deloitte highlights “value-seeking consumers” as a foundational shift shaping retail dynamics in 2026 (Report, Jan 2026).

What I’d Do This Week:

- Make “why this costs what it costs” obvious: materials, guarantees, shipping speed, support.

- Test bundles that increase perceived value without destroying margin.

- Improve price transparency: show shipping thresholds, delivery dates, and return terms near CTA.

- Build a “trust stack” on PDP: reviews, UGC, warranty, and clear product specs.

Watch-Out: If you respond to value-seeking with constant discounts, you train customers to wait—and you crush your own contribution margin.

Ecommerce Trend 8: Privacy Rules Expand, And Measurement Gets More Fragile

What it is: More privacy requirements, more opt-out tooling, and more scrutiny on automated decision-making and data brokers. Meanwhile, browser policy shifts continue to create uncertainty in tracking.

Why it matters in 2026: Marketing teams need reliable first-party measurement and consent-respecting data flows, or they’ll fly blind on CAC and LTV.

Proof point: IAPP notes new US state privacy requirements coming online in early 2026, including California rules and delete/opt-out mechanisms (Article, Jan 2026). Reuters also reports Google’s direction on third-party cookie changes and ongoing debate around cookie-related changes (News report, Apr 2025).

What I’d Do This Week:

- Audit consent flows: ensure analytics and marketing tags respect opt-out choices.

- Strengthen first-party tracking: server-side events where feasible, plus clean UTM discipline.

- Move attribution expectations toward blended measurement (incrementality tests + platform reporting).

- Document data handling for vendors (who receives what data, and why).

Watch-Out: “We’ll fix tracking later” is expensive. The longer you wait, the harder it is to compare performance year-over-year.

Ecommerce Trend 9: Unified Commerce And Faster Fulfillment Separate Winners From Strugglers

What it is: Unifying inventory, orders, and customer context across channels to support faster, more reliable fulfillment and more consistent experiences.

Why it matters in 2026: Delivery expectations keep rising. If your systems are fragmented, you’ll lose money in operations and lose customers in experience.

Proof point: Deloitte points to supply chain transformation and resilience as a key 2026 dynamic (Report, Jan 2026). NRF also discusses operational shifts and AI-driven changes impacting retail execution (Article, Jan 2026).

What I’d Do This Week:

- Fix stock accuracy issues that cause cancellations (they destroy trust instantly).

- Expose delivery promises clearly on PDP and cart (date estimates beat vague “fast shipping”).

- Review fulfillment SLAs vs what your site promises; align marketing with reality.

- Instrument “shipping surprise” drop-offs: cart exits after shipping is revealed.

Watch-Out: Speed without reliability is worse than “slower but accurate.” Late deliveries create support tickets, refunds, and negative reviews that snowball.

Ecommerce Trend 10: CRO Shifts From “Page Tweaks” To Behavior Diagnosis

What it is: Conversion work becomes more diagnostic: understand where users hesitate (scroll depth, rage clicks, form friction, trust gaps), then fix the system—not just button colors.

Why it matters in 2026: When every channel gets more competitive, the cheapest growth is often improving the on-site journey you already paid for.

Proof point: Baymard’s checkout research emphasizes how persistent checkout issues contribute to high abandonment (Research page). Deloitte also stresses data-driven insight and AI-led marketplaces reshaping how retail competes (Report, Jan 2026).

What I’d Do This Week:

- Map your funnel by device: product view → add to cart → checkout start → purchase.

- Watch 20 session recordings from paid traffic and 20 from returning customers; compare friction.

- Identify 3 “micro-frictions” that kill momentum (slow PDP, confusing variants, hidden fees).

- Run one high-signal test (checkout simplification, shipping clarity, PDP trust stack) and measure CR + refund rate.

Watch-Out: Testing random ideas wastes weeks. Start with behavior evidence, then test the highest-impact friction first.

How Plerdy Helps You Act on These Trends

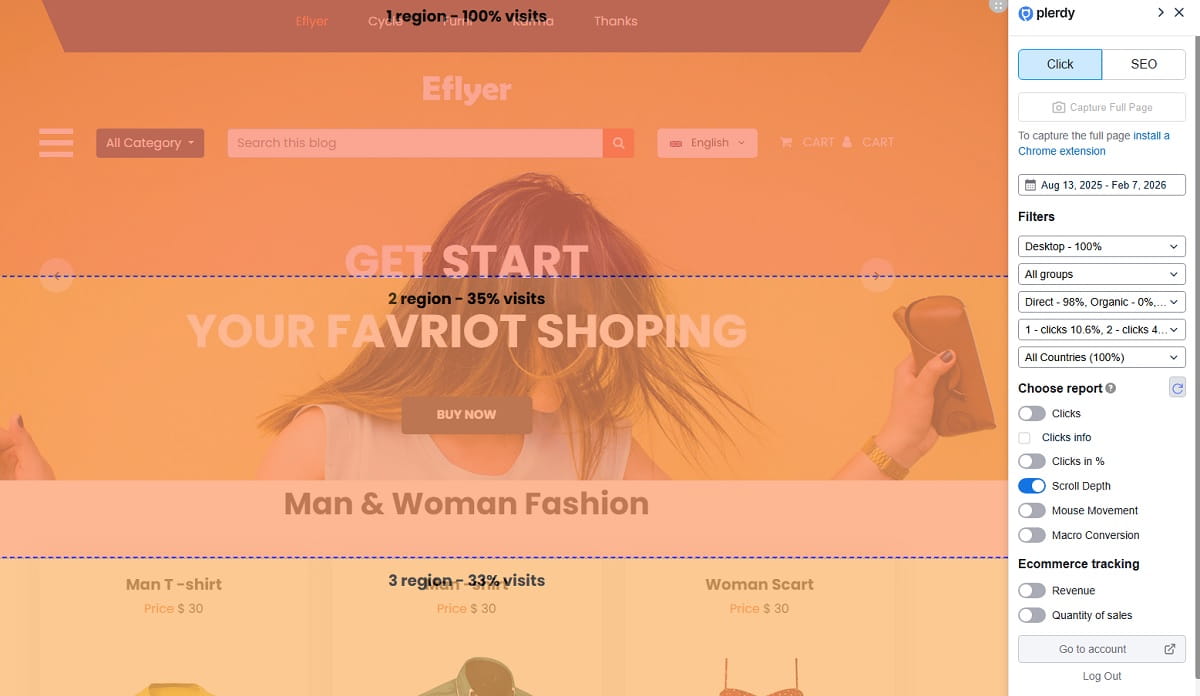

Most teams don’t struggle to list trends—they struggle to connect trends to what shoppers actually do on their site. Plerdy is useful when you need to translate “2026 change” into measurable behavior on real pages: heatmaps, scroll depth, session recordings, funnels, and fast conversion friction diagnostics. And when you need a quick reality check, the Lost Revenue Analysis / Lost Revenue Report helps you spot where money leaks without pretending every problem is “traffic quality.”

- AI/Agentic Shopping: Measure PDP engagement (scroll depth + clicks) and fix missing specs, weak comparison info, and unclear shipping/returns. Use Plerdy Heatmaps to see what shoppers try to use as “decision shortcuts.”

- Personalization: Identify where users hesitate (variant selection, sizing, delivery promise). Validate changes with funnel steps in Plerdy Funnels before rolling out sitewide.

- Social Commerce: Watch session recordings from social traffic to catch expectation mismatches (they often show up as fast bounces and frantic scroll). Use Plerdy Session Recordings to pinpoint where the story breaks.

- Retail Media Spillover: Track landing page friction for “high intent” traffic and reduce drop-offs at PDP and cart. Use Plerdy Conversion Friction Diagnostics to find the exact blockers.

- Checkout Simplification: Use click maps to spot dead clicks and form confusion. Pair that with funnel drop-off to prove where checkout bleeds users. Start here: Checkout UX Analysis.

- Returns Control: Compare sessions and heatmaps on high-return SKUs to improve clarity (fit, sizing, materials) and reduce “surprise returns.” Link this to revenue leakage with Lost Revenue Report.

- Value-Seeking Behavior: Measure whether shoppers reach pricing, shipping thresholds, warranty, and reviews. If they don’t, your value story is buried—fix layout and hierarchy using Scroll Depth Reports.

Quick 2026 Ecommerce Trends Checklist

- My product data is consistent (titles, attributes, compatibility, bundles).

- PDP clearly answers: “what it is,” “why it’s worth it,” “when it arrives,” “how returns work.”

- Checkout shows total cost early and stays simple on mobile.

- Payment options match customer preference (wallets, BNPL where relevant).

- I track funnel steps by device and by channel (especially social).

- I review session recordings weekly for top landing pages and top SKUs.

- I tag return reasons and tie them back to specific PDP issues.

- I test changes based on behavior evidence, not opinions.

- Consent and privacy controls are audited and documented.

- I have a plan for reliable first-party measurement (not just platform dashboards).

What Are The Most Important Ecommerce Trends For 2026?

The biggest themes are AI-driven commerce (including agent-like shopping flows), social checkout growth, retail media expansion, tighter privacy requirements, and operational excellence (checkout, fulfillment, returns). The most practical way to prioritize is to focus on what moves CR, AOV, CAC, refund rate, and repeat purchase.

How Do I Prioritize Which Trend To Work On First?

Start where money leaks fastest: checkout drop-off, PDP confusion, and returns. If you’re paying for traffic, fixing friction in checkout and product pages usually beats chasing new channels. Use behavior evidence (funnels, recordings, heatmaps) to pick the first fix.

Is Social Commerce Worth It For Smaller Brands In 2026?

Yes—if you treat it like a product channel, not just ads. Social commerce works best when you pair creator content with a simple offer, fast variant selection, clear delivery expectations, and strong post-purchase support.

What Should I Change In Checkout For 2026?

Simplify the flow: reduce unnecessary fields, show total cost early (shipping/taxes/fees), make delivery promises explicit, and ensure the mobile checkout is effortless. Most stores get faster CRO gains from removing checkout friction than from redesigning the homepage.

How Do Privacy Changes Affect Ecommerce Marketing In 2026?

Privacy rules and opt-outs are expanding, so measurement can get more fragile if you rely on sloppy tracking. Build stronger first-party measurement, keep consent flows clean, and combine platform reporting with incrementality testing. In practice, ecommerce trends 2026 reward brands that can measure performance without over-tracking users.

Conclusion

The ecommerce trends for 2026 reward teams that connect hype to behavior: what shoppers click, where they hesitate, and why they leave. If you treat 2026 as “just more channels,” you’ll keep paying for traffic while conversion rate and refund rate quietly punish you. Pick two trends that hit your business hardest, measure the friction on PDP, cart, and checkout, and ship one fix this week. Tools like Plerdy help you see the money leaks fast and turn trends into practical CRO actions.