If SEO were an Olympic event, financial services would most definitely grab the gold for its competitive advantage! SEO is a major player in the game of visibility and trust in the financial industry, not only about keywords. Mastering SEO in banking is an art; rules as tight as a high-wire performance. This is where Plerdy turns the difficult SEO terrain into a clear road plan for success. We are delving into the realm of SEO for financial services catered for 2024 in this article, thus making sure your plan is modern and ahead of the curve.

Understanding SEO in Financial Services

Ever curious about how a financial company ranks first on Google? Mastery of SEO is everything. SEO is the ticket to remain relevant and visible in the hectic financial environment, not only a jargon. Let’s decipher this digital riddle.

Fundamentals of SEO

SEO increases Google view of your website. Key is knowing what your possible clients search for online, the language they use, and the content they consume. In the financial industry, where accuracy and confidence rule, SEO transcends keywords. It entails making your website so it is not only found but also trusted. For example, Moz’s research emphasizes the need of premium content and link-building for SEO.

SEO’s Role in Financial Services

Within financial services, SEO is a strategic actor. It’s not only about showing a customer to your website; it’s also about clearly and dependably directing them through a labyrinth of offerings. SEO helps the consumer clarify the sometimes complicated financial subjects. SEO closes the gap between financial companies and their potential customers whether they are seeking understanding of many kinds of insurance or investment guidance.

The Search Engine Journal advises financial firms to concentrate on mobile optimization and localized SEO. This is so since many searches take place on mobile devices and many financial decisions are locale based. Compliance is also very important. Financial companies have to make sure their material satisfies legal criteria while being search engine optimized and negotiate a sea of rules.

In financial services, SEO is about developing a relationship based on trust and knowledge, not only about obtaining visitors. We follow SEO best practices and cultivate a devoted clientele by dissecting difficult financial language into something a layperson can grasp.

As we draw to a close financial services One continuous process is SEO. It means following the always shifting digital trends and rules. By means of a strong SEO plan and building long-term confidence with their audience, financial services can improve their digital presence. It’s ultimately about being the consistent lighthouse in the financial mist.

Key Challenges and Opportunities in Financial Services SEO

Financial SEO is like a measured but challenging game of high stakes chess. These difficulties do, however, also offer great chances. Let us travel over this complex terrain.

Getting Around Legal Restraints

Financial services are built on regulatory limits. search engine optimization Financial companies have to match their material with strict policies established by agencies like the Securities and FINRA. Legal consequences and mistrust might follow from mistakes. Every bit of material has to be checked for conformity to guarantee it is accurate and not deceptive. This loyalty can have two negative effects: it inhibits marketing innovation even while it preserves ethics. This limitation does, however, also offer a chance to foster confidence. Companies build credibility and dependability by always offering accurate, compliant information. As Forbes points out, in financial services openness and trust are absolutely essential.

Overcoming Keywords in Competition

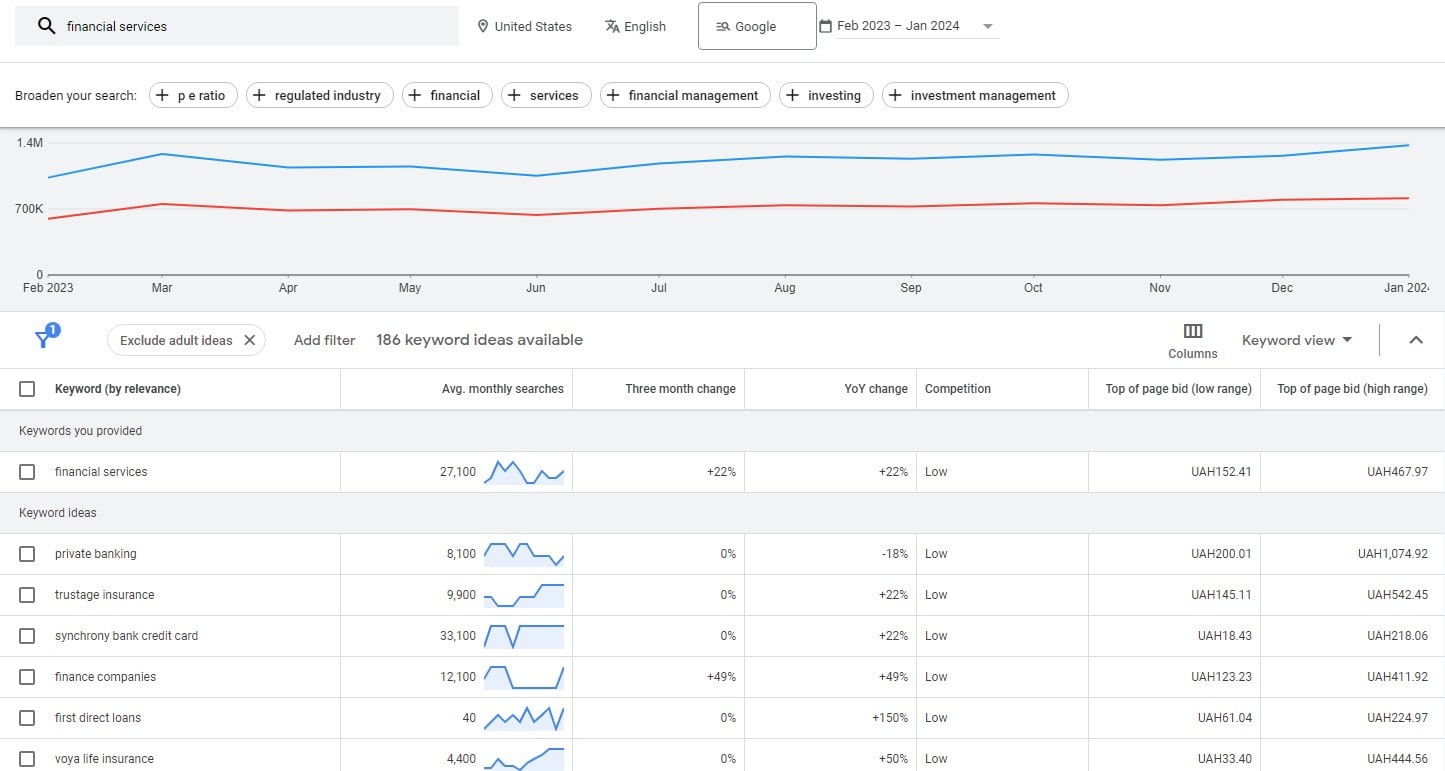

In financial SEO, the battlefield is competitive keywords. Many companies fight for shared keywords, therefore raising expenses and hiding each from view. Companies that want to stand out should concentrate on specialty, long-tail keywords, which, based on a study by Ahrefs, have less competition and usually draw more quality leads. Crucially, you must know the particular requirements and language of your target market. Targeting “retirement investment advice for seniors” instead of vying for more general phrases like “investment banking,” for instance, can result in more concentrated and significant participation.

Getting Used to a Digital Landscape Always Changing

Particularly when considering SEO, the digital sphere is always changing. Constantly changing Google’s algorithms need for financial service providers’ flexibility and agility. Maintaining these modifications is absolutely vital. For example, Google’s BERT upgrade underlined the need of user-oriented materials and natural language. Financial companies have to concentrate on producing material that clearly, simply and easily addresses the problems of their clients. This is a strategy Search Engine Land highly supports: evaluating and updating website content to guarantee relevance and accuracy.

Using Technology and Data Analytics

Search engine optimization depends critically on data analytics and technology. Tools that provide insightful analysis of consumer behavior, preferences, and search patterns include Google Analytics and SEMrush. Examining this information helps financial companies customize their SEO plans to fit client demands. This can cover everything from knowing the best content styles for their readers to spotting the most successful keywords. Moreover, as indicated in a Deloitte research, technologies like artificial intelligence and machine learning are starting to be quite important in customizing user experiences. Using these technologies will enable financial services to provide more relevant, tailored material, hence enhancing user involvement and SEO results.

Constructing Online Trust

Foundation of financial services is trust. In an industry sometimes seen with mistrust, building and keeping trust online is absolutely critical. This can be accomplished with continuously high-quality material that offers insights and meets consumer needs. Moreover, as Trustpilot emphasizes, using customer reviews and success stories would help greatly increase credibility. With every online encounter, SEO techniques should raise results and create dependability and security.

Within the difficult field of financial services Huge chores are SEO, negotiating legal restrictions, standing out among competitive keywords, and creating online trust. Still, we find routes to credibility, specificity, and creativity among these difficulties.

As we draw to close, it is abundantly evident that overcoming challenges into stepping stones is the secret to improving SEO in financial services. By knowing and adjusting to legal restrictions, focusing on particular keywords, and building confidence, financial companies may survive and flourish in the digital terrain. The ultimate aim is to develop an online presence that is strong and respected by means of a merging of compliance, visibility, and trust.

Effective SEO Strategies for Financial Services in 2024

financial services SEO is not a trend; it is very necessary for 2024. Our SEO approach has to evolve with the internet environment. Let’s release the possibilities of well crafted SEO techniques specifically for the finance industry.

Keyword Research and Optimization

Good search engine optimization begins with exact keyword research. For financial services, this entails looking for niche keywords that meet the particular needs of your target market outside of broad terms. Search relevant but not overly saturated keywords using tools like Google’s Keyword Planner and SEMrush. It relates more to relevant traffic than just heavy traffic. For instance, more exact keywords like “state planning for retirees” or “small business accounting services” could produce better results than broad ones like “financial services.” The research of Ahrefs shows the need of focusing on long-tail keywords to increase conversion rates.

Leveraging Local SEO

Financial companies with physical locations depend on local SEO. Add relevant information to your Google My Business profile. Ask customers to post evaluations; good comments improves local search results. Include local keywords into the material of your website. If your company is headquartered in New York, for instance, keywords like “New York financial advisory services” can help local visibility. Moz stresses the need of local SEO in increasing visitors to physical stores.

Content Marketing for Finance

In SEO, content rules; this is especially true for financial services. Make your audience find great value in your content marketing strategy. This can contain movies on subjects like financial planning, investing methods, or market trends as well as educational blog entries and whitepapers. The material ought to be interesting, educational, and most importantly compatible with financial laws. Use your material to respond to often asked questions by your customers, therefore establishing your company as a reputable and informed industry player. HubSpot emphasizes how good content can draw in and interact with the appropriate audience to create devoted customers.

Technical SEO Factors

Your content strategy is built upon technical SEO. Since so many searches are conducted on mobile devices, make sure your website is mobile-friendly. Another important factor is site speed; a slow-loading site can discourage possible customers. Use SSL encryption to guard your website; Google like safe websites, so this helps your search results and protects the data of your clients. Look over your website for tags, duplicate material, and broken links. Google’s PageSpeed Insights and other tools can offer insightful analysis of the technical performance of your website.

For financial services in 2024, effective SEO plans call for exact keyword research, local SEO optimization, interesting content marketing, and strong technical SEO. These techniques are not stand-alone; rather, they cooperate to increase your internet profile, draw the correct audience, and position your company as a leader in the financial industry.

Proper application of these techniques can greatly influence the competitiveness of financial services in the digital environment. Maintaining ahead in SEO as the company develops depends mostly on being relevant, reliable, and easily reachable to clients.

Adhering to Compliance and Building Authority

SEO in the financial services industry is about negotiating the tightrope of compliance while creating unquestionable authority, not only about keywords and ranks. Let’s look at how to properly balance these key components.

Recognizing E-A-T and YMYL

Under Google’s “Your Money or Your Life” (YMYL) category, financial services fit and require premium content that affects consumers’ financial security. Following these rules helps you to keep the integrity and credibility of your offerings in addition to improving your SEO. Here E-A-T (Expertise, Authoritativeness, and Trustworthiness) finds application. Your material ought to represent authoritative ideas and professional knowledge. This entails creating factually correct, well-researched material created either directly by field experts or under review. A blog post on retirement planning, for example, should be written by a certified financial planner or checked over by one. The Harvard Business Review claims that, particularly in banking, experience helps to develop client confidence.

Increasing Online Authority and Trust

Establishing online authority in the financial industry requires more than simply having a specialist produce your material; it also requires building a complete digital presence reflecting your credentials and experience. This includes obtaining backlinks from credible financial sector websites, which act as testimonials to the relevance and quality of your material. Backlinko’s research shows that, especially for YMYL sites, backlinks are a major ranking consideration. Furthermore improving your online presence and fostering trust is consistent interaction with your audience via social media, forums, and blog comments. Responding to questions, providing guidance, and sharing ideas on LinkedIn other finance-specific forums helps your company project as a useful and informed expert.

negotiating the financial services’ compliance-heavy seas Building authority and SEO call for a dedication to quality, knowledge, and participation. Emphasizing E-A-T and YMYL ideas and aggressively establishing the online authority of your company will open the path for improved rankings and developing strong confidence with your readers.

In this digital age, your online authority is as valuable as your in-person reputation. Maintaining compliance and developing trust by means of quality content and interaction goes beyond just rule-following; it also helps your company to become a major voice in the financial sector. These techniques help you create a legacy of trust and knowledge rather than only maximizing for search engines.

Measuring SEO Success in Financial Services

In financial services, SEO success represents the digital pulse of your company rather than only a vanity statistic. Let’s explore how precisely and wisely you could evaluate the success of your SEO campaigns.

Important Financial Services SEO Measures

For financial services SEO, organic traffic, keyword ranks, and conversion rates score highest among the KPIs.

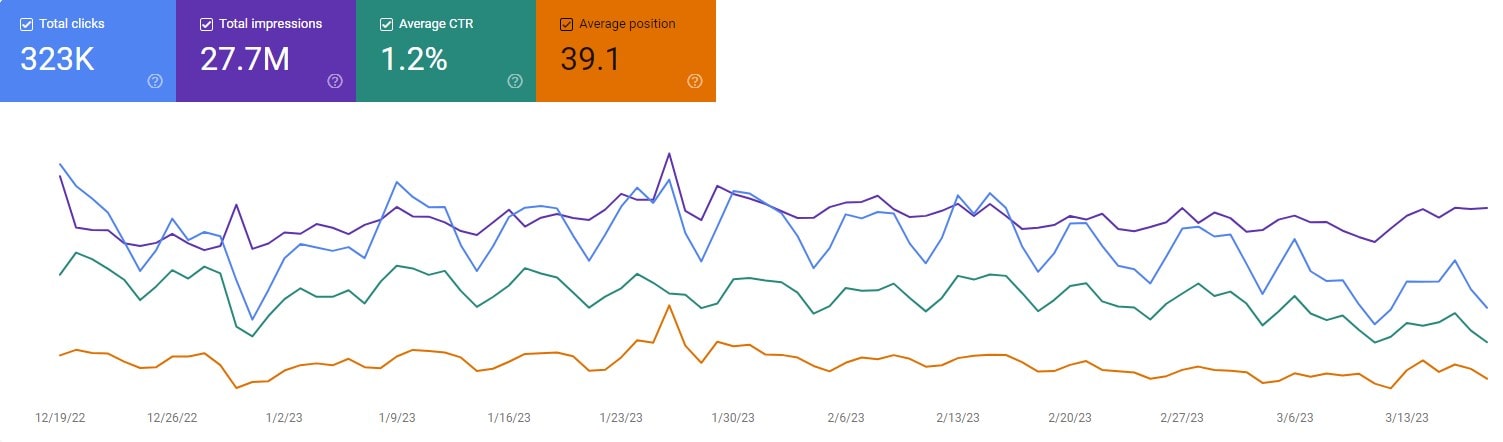

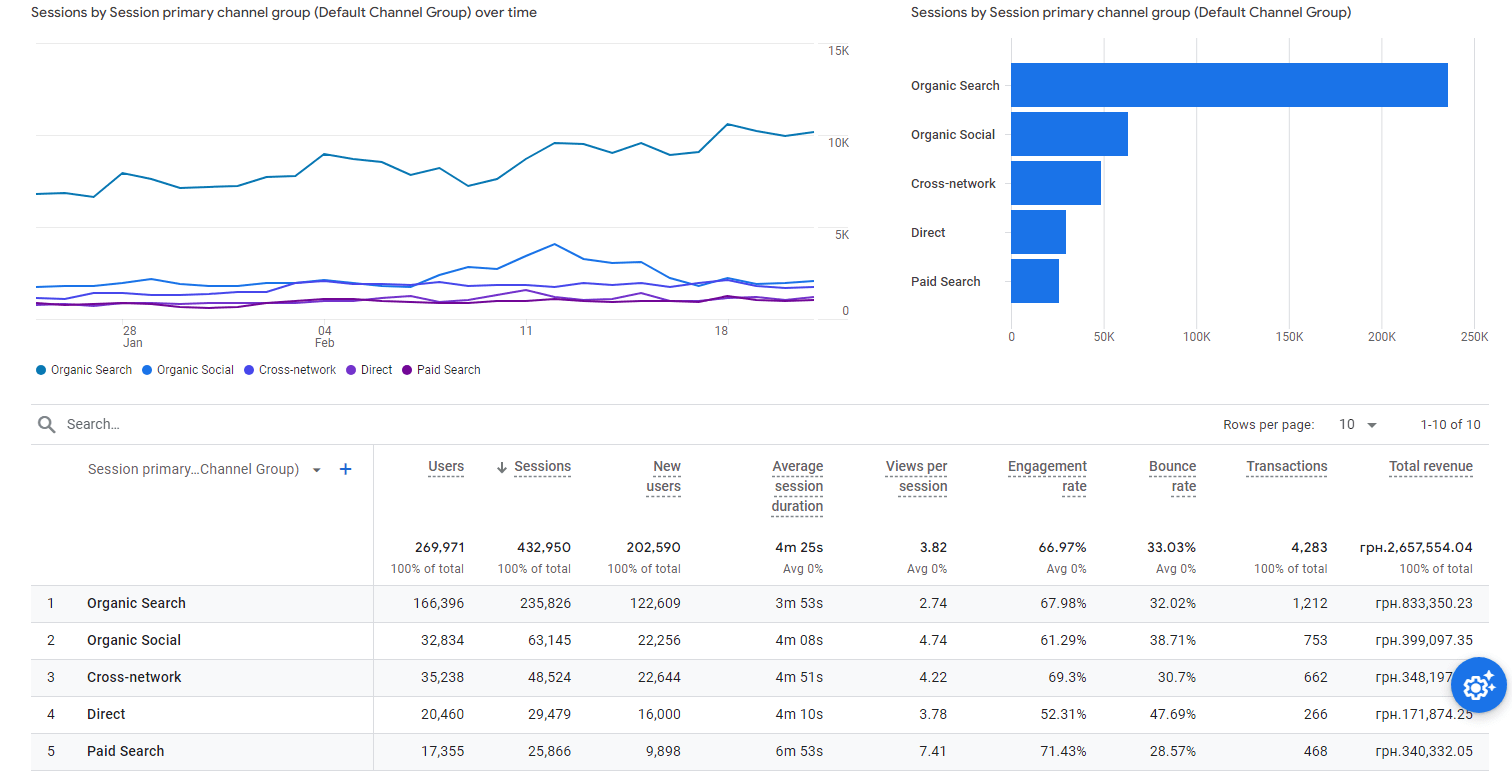

- Organic Traffic: This gauges search engine activity to your website. An ongoing rise in organic traffic points to successful SEO strategies. Tools like Google Analytics provide thorough understanding of traffic patterns, sources, and user activity of your website.

- Track where your website ranks for specific keywords to gather ideas. Rising search results for particular, relevant keywords indicates that your SEO is on target. Excellent tools for tracking keyword ranks and analyzing the competitive scene include SEMrush and Ahrefs.

- Conversion rates are In financial services, SEO’s ultimate objectives are not only to increase traffic but also to turn visitors into customers. Track how many people finish a desired action—such as downloading a guide or completing a contact form. This measure links your SEO initiatives directly to return on investment.

Measurement Tools and Strategies

Accurate assessment of SEO success depends on using the correct tools and methods. Measuring demographics, session length, and bounce rates calls for Google Analytics. Combining Google Search Console offers more analysis of search queries, click-through rates, and website health.

Furthermore, HubSpot and other CRM platforms enable tracking of conversions from natural search, therefore offering a clear image of how SEO results in client acquisition. Customizing these tools’ dashboards to highlight the indicators most important to your financial company will help your team remain always informed and ready to adjust tactics as necessary.

Accurately gauging SEO performance in financial services calls for tracking the correct benchmarks and applying advanced techniques. Companies can evaluate the success of their SEO plans and improve them for better outcomes by concentrating on organic traffic, conversion rates and keyword rankings and using tools like Google Analytics and CRM systems.

Remember that these indicators of your SEO performance are insights into your client’s demands and actions, not just numbers. Knowing and using these benchmarks can help your SEO show and raise client involvement and happiness.

Future Trends and Predictions for SEO in Finance

SEO in finance is transforming client connection between financial companies, not only changing their approach. Let’s find the developments poised to change the SEO scene in banking as we head toward 2024.

Impending changes in SEO algorithms

Future of SEO in finance will be much influenced by continuous algorithm changes from search engines like Google. These upgrades give user experience top priority, therefore favoring websites with quick load times, mobile optimization, and excellent, interesting content. Including artificial intelligence and machine learning into algorithms helps search engines to get smarter in comprehending user intent and providing tailored results. This means for financial institutions adjusting to a more dynamic SEO approach fit for these changing algorithms. Maintaining and improving search engine results will depend on recognizing and quick reacting to algorithm changes, according to Search Engine Journal.

Changing User Expectations and Behavior

With a growing desire for customized and instantaneous information, the expectations and behaviors of financial services consumers are fast changing. Financial institutions have to use data analytics and artificial intelligence to provide customized content as digital natives start to occupy more of a market. Voice search is also growing more common, which calls for a change in keyword approaches to more conversational and long-tail words as Forbes observed. ESG considerations are growing in relevance, hence individuals look for financial services aligned with their values. Financial companies have to maximize their material to show these changing tastes.

Technological Developments in SEO

Technological developments will define financial services SEO. Combining artificial intelligence and machine learning for predicted search activities and customized content curation will take front stage. Blockchain technology could also affect SEO by providing fresh means of verifying and safeguarding online material, so influencing search engine results. Furthermore, AR and VR in financial services marketing could generate interesting and immersive materials, therefore raising user involvement and SEO. Deloitte’s research shows how these technologies are poised to revolutionize the financial services sector.

Expect and react to these developments to keep ahead in financial services SEO. By adopting future algorithm modifications, realizing changing user behaviors, and using technology advancements, financial companies can guarantee they stay at the forefront of digital marketing.

These developments show the need of adaptability and foresight in SEO strategy as we get ready for 2024 and forward. The digital future will be successful for those who foresee and adjust since finance is always changing.

Finally

Remember that, just like the financial markets themselves are dynamic and always changing as we conclude our trip through SEO for Financial Services in 2024. Your approach should be as flexible and changeable as the sector you operate in. Still, your search for better SEO is only starting. Explore further ideas and advice in our other Plerdy publications, each a fresh piece of the digital marketing jigsaw. And Plerdy’s tools help you when you’re ready to elevate your financial services SEO. Let us overcome those digital obstacles together.