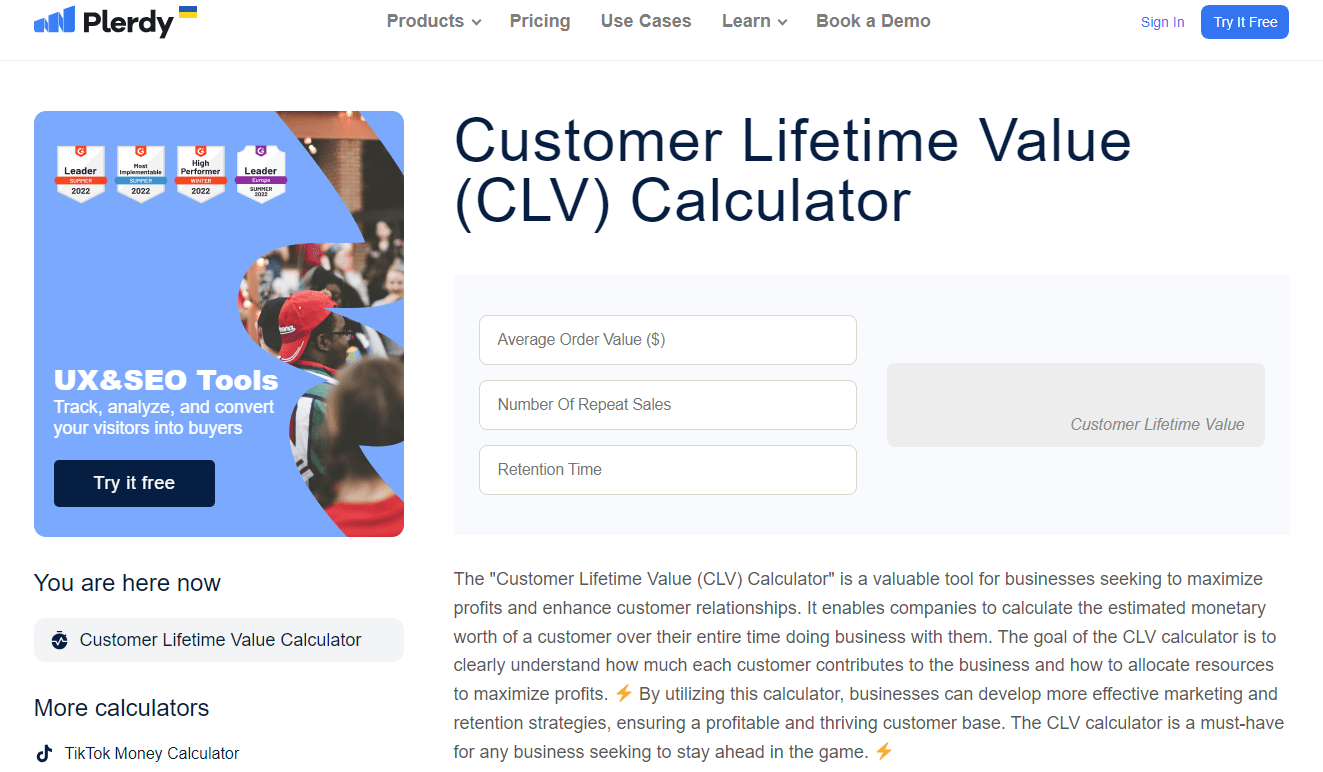

Welcome to the definitive guide to Customer Lifetime Value (CLV)—your roadmap to understanding this indispensable metric. 🚀 CLV shows how much a customer is worth to your business over time. Let’s cut to the chase—this is not just another number; it’s the lifeline your business depends on to make informed decisions. Knowing the CLV can drive targeted marketing, influence product launches, and optimize your sales strategies.

Here’s a sneak-peek into what you’ll discover:

- Metrics Synergy: How CLV harmonizes with other key business metrics

- Strategies and Tactics: Implement the best practices that elevate CLV

- Case Studies: Real-world success stories across diverse industries.

For those eager to optimize every customer touchpoint and improve conversion rates—step up your game with Plerdy tool for CRO & UX. This multi-functional platform transforms guesswork into strategy, allowing you to forge relationships that not only last but also add sustainable value to your business. 📈

In the next few minutes, you’ll unravel the facets of CLV that can catapult your business into long-term profitability. Let’s dive in! 🌊

Components of CLV

When diving deep into the components of Customer Lifetime Value (CLV), businesses focus on three pivotal areas to gauge the true value a customer brings over their engagement span:

- Average Purchase Value: For instance, in the e-commerce sector, this measures the typical amount a shopper spends per transaction.

- Purchase Frequency: Subscription services, like streaming platforms, assess how often subscribers utilize their platform, shedding light on consistent engagement.

- Customer Lifespan: In the hospitality niche, hotels might analyze how many years a guest keeps coming back.

By breaking down these components, businesses extract insights to bolster strategies and elevate the overall customer experience.

Average Purchase Value (APV)

In the lexicon of Customer Lifetime Value (CLV), Average Purchase Value (APV) stands as a cornerstone metric. Businesses zero in on APV to unlock granular insights into individual customer behavior. Take, for instance, the gourmet coffee industry. Here, cafes can determine not just the common cup size purchased, but also the additional items like pastries or merchandise—giving a full spectrum of consumer spend.

- Coffee Price Points: Various brews come at different costs, affecting APV.

- Added Value: Customer choices in upscales like organic milk or flavored syrups.

- Merchandise: How often a branded mug or coffee beans get tacked onto an order.

Understanding APV allows businesses to finetune pricing, optimize inventory, and roll out promotions that resonate with customer preferences, enhancing lifetime value in the process.

Purchase Frequency (PF)

When it comes to carving out robust Customer Lifetime Value (CLV) profiles, Purchase Frequency (PF) often tips the scale. Businesses in different industries leverage PF to map out customer habits and adjust their offerings accordingly. Take a fitness center, for instance, where PF might reflect the frequency of monthly visits or the purchasing of add-on classes:

- Monthly Visits: Higher frequency signifies customer satisfaction and engagement.

- Add-On Purchases: The rate at which members opt for special classes, workshops, or gear.

- Seasonal Peaks: Notable surges in visit rates during, say, New Year’s resolutions or summer fitness pushes.

By decoding PF metrics, businesses are empowered to adapt their marketing efforts, fine-tune service offerings, and build stronger, more profitable relationships over a customer’s lifetime.

Customer Lifespan

In the landscape of Customer Lifetime Value (CLV), the length of a Customer Lifespan emerges as a vital component. Savvy businesses dissect this metric to draw conclusions about long-term engagement and loyalty. Consider the realm of software-as-a-service (SaaS). Here, the length of subscriptions and renewals paints a vivid picture:

- Starter Subscriptions: Often short-term, indicating tentative trials.

- Annual Renewals: A sign of deeper commitment and satisfaction.

- Version Upgrades: Reflects continued trust in the product over time.

By diving into Customer Lifespan data, enterprises can pinpoint moments to re-engage, re-invent, and reward—ultimately driving up the lifetime value and bolstering the bond with their clientele.

Churn Rate

When mapping out Customer Lifetime Value (CLV), Churn Rate inevitably steps into the spotlight. It’s the stat businesses wish to minimize as it directly impacts customer lifespan and, by extension, overall value. For online grocery delivery services, Churn Rate might manifest in cancelled subscriptions or dwindling orders:

- Cancelled Subscriptions: A high volume spells trouble and necessitates immediate action.

- Single-Purchase Customers: Those who place an order and never return.

- Dormant Accounts: Inactive for a set period, marking potential churn before it happens.

By closely monitoring Churn Rate, businesses can pull out all the stops to re-engage drifting customers, roll out irresistible offers, and cultivate loyalty—all key maneuvers to optimize CLV.

Calculating CLV

When it comes to sharpening your CLV lens, calculating Customer Lifetime Value is paramount. Various industries employ different formulas, but they all boil down to a combination of Average Purchase Value, Purchase Frequency, and Customer Lifespan. For example, in the automotive sector, the focus might include:

- Car Sales: Initial purchase cost sets the APV benchmark.

- Service Visits: Regular maintenance ramps up Purchase Frequency.

- Trade-Ins: Reflect the duration of a customer’s engagement or their lifespan with the brand.

By crunching these numbers, businesses create a reliable CLV figure, enabling them to dish out personalized offers, streamline inventory, and roll out effective marketing strategies to enhance customer value over their lifetime.

Simple CLV Calculation

For businesses keen on cutting through complexity, Simple CLV Calculation provides a straightforward approach to gauge Customer Lifetime Value. Essentially, it boils down to multiplying the Average Purchase Value (APV) by Purchase Frequency (PF), then stretching that by the average Customer Lifespan. For the fast-food industry, these metrics are vital:

- Combo Sales: Serves as the benchmark for APV.

- Weekly Visits: The cornerstone for assessing PF.

- Loyalty Membership Duration: Acts as the yardstick for Customer Lifespan.

Once you’ve plugged in these variables, Simple CLV Calculation reveals a numerical value, offering a bird’s-eye view of a customer’s worth to your operation. With this figure in hand, businesses can tailor their menu specials, punch up loyalty rewards, and engage in targeted advertising that resonates with their customer base, maximizing value across the board.

Traditional CLV Calculation

When you’re focused on unearthing the granular details of Customer Lifetime Value, Traditional CLV Calculation serves as the gold standard. This method incorporates not only APV and PF but also adjusts for customer retention rate and discount factor. In the realm of luxury retail, for instance, key elements could be:

- Designer Sales: Establishes the APV, given the high ticket items.

- Seasonal Buys: Gauges the PF, as luxury items are often not everyday purchases.

- VIP Retention: A measure of how long these high-value customers stick around.

By taking these metrics into account and applying the formula, businesses unearth a highly nuanced picture of CLV. This precise figure enables them to tweak marketing efforts, fine-tune inventory levels, and construct highly personalized engagement strategies, maximizing customer value through each stage of their lifetime journey.

Using Predictive Analytics for CLV

Harnessing the power of Predictive Analytics for CLV takes your business strategy to a league of its own. Machine learning algorithms and historical data can better predict consumer value. Let’s dive into the hospitality industry as an example:

- Room Upgrades: Predictive models can anticipate when a customer is likely to opt for a luxury suite, increasing their lifetime value.

- Loyalty Programs: Algorithms can project the long-term impact of rewarding frequent guests, thus affecting their CLV.

- Seasonal Offers: Pinpoint the exact times customers are prone to book, enabling laser-focused, cost-effective marketing campaigns.

In a nutshell, predictive analytics fine-tune your approach by zeroing in on trends, personal preferences, and spending habits to optimize customer value, secure long-lasting relationships and ultimately boost business profitability.

Benefits of Measuring CLV

Measuring CLV elevates your business strategy by sharpening focus on high-value customers, improving ROI, and enhancing long-term success. For instance, in the subscription-based SaaS industry:

- Budget Allocation: Know where to pour resources by zeroing in on customers with high lifetime value, thus optimizing marketing and sales efforts.

- Customer Segmentation: Segment your audience based on CLV data, then tailor services to meet individual needs.

- Risk Mitigation: Identify customers at risk of churning early, enabling preemptive action.

By tracking CLV, businesses gain laser-focused insights into customer behavior, creating a roadmap for sustained profitability. It’s not just a metric; it’s a cornerstone for business stability.

Enhanced Marketing Strategies

Harnessing CLV data supercharges your marketing arsenal, enabling laser-focused campaigns that yield robust ROI. For example, the luxury goods sector often grapples with a broad customer base yet aims to cater to high-value clientele. Here’s how CLV data refines your marketing strategies:

- Tailored Outreach: Customize promotions for customers with high CLV, maximizing retention and upselling opportunities.

- Resource Optimization: Allocate marketing dollars precisely where they’ll get the most traction, like targeting top-tier customers via premium channels.

- Revenue Forecasting: Utilize CLV to predict future revenue streams, allowing for more strategic planning and growth scaling.

By integrating CLV metrics into your marketing playbook, you essentially fine-tune your approach, fostering lifetime customer relationships that drive long-term business vitality. It’s like hitting the sweet spot in a golf swing—effortlessly precise and exceedingly effective.

Improved Customer Retention

Leveraging CLV not only amplifies revenue but significantly enhances customer retention—essential for long-term business sustainability. Take the SaaS industry; churn can be a debilitating issue. By using CLV to segment high-value customers, strategies can be fine-tuned to encourage enduring relationships.

- Personalized Perks: Roll out targeted incentives, like premium feature access, to retain high CLV customers.

- Engagement Tracking: Pinpoint and engage wavering customers before they hit the exit ramp, utilizing real-time data metrics.

- Value Reinforcement: Periodically showcase the quantifiable benefits customers have gained, confirming why sticking around pays off.

Implementing such data-driven, customer-centric retention tactics not only solidifies current relationships but also adds luster to your brand reputation. It’s not just about holding onto your clientele; it’s about intensifying the value exchange, enriching the customer journey for a lifetime.

Resource Allocation and Budgeting

Mastering CLV isn’t just good for customer relationships; it’s a linchpin for optimal resource allocation and budgeting. Think about the fashion retail sector. Without understanding lifetime customer value, you might pump dollars into flashy advertising when your real goldmine is word-of-mouth referrals from existing high-value customers.

- Precision Marketing: Allocate more funds to marketing channels that engage high CLV customers, such as exclusive newsletters or premium customer events.

- Inventory Management: Prioritize stocking items that historically attract and retain your highest CLV clients.

- Customer Service Upgrades: Designate top-tier service resources, like express support lines, exclusively for customers with robust lifetime values.

By putting your money where your CLV is, you craft a financial strategy laser-focused on fostering value at every customer touchpoint. The result? Maximized ROI, minimized waste, and a business built for resilience.

Segmentation and Personalization Opportunities

Diving deep into CLV data unravels opportunities for segmentation and personalization, the backbone of modern business success. Consider the gourmet coffee industry:

- Taste Profiles: By segmenting customers based on their purchasing habits, businesses can whip up personalized offers. Espresso lovers get tailored discounts on dark roasts, while latte enthusiasts receive frothing tool promotions.

- Brewing Preferences: Know a segment prefers cold brew? Introduce them to your latest cold-steeped concoctions.

- Purchase Frequency: Reward high CLV customers who order monthly with exclusive beans or brewing guides.

With such precision targeting, businesses not only engage customers better but also boost value throughout their entire lifetime. So, instead of casting a wide net, zero in on what each customer segment truly craves.

Pitfalls to Avoid When Calculating CLV

Navigating the intricate landscape of CLV can be a slippery slope, especially when miscalculations tarnish your data’s integrity. Consider the fast-food industry:

- One-Size-Fits-All: Avoid slapping the same lifetime value on every customer. Remember, a weekend visitor isn’t the same as a daily regular.

- Ignoring Churn: Don’t skip over customers who exit early; their exit patterns can offer insights.

- Short-Term Gaze: Focusing solely on immediate profits skews CLV, underestimating long-term engagements.

By sidestepping these pitfalls, you amplify your CLV’s accuracy, setting the stage for more effective business decisions and elevating customer value across lifetimes.

Ignoring Customer Segmentation

When it comes to CLV, bypassing customer segmentation is like driving blindfolded—dangerous and counterproductive. Consider the SaaS industry; treating a multinational corporation as you would a startup creates inefficiencies and dilutes value.

- Generic Outreach: Personalized emails beat generic blasts every time.

- Inconsistent Pricing: A tiered pricing strategy can optimize value extraction from different customer types.

- Resource Misallocation: Targeting everyone usually means effectively reaching no one.

By embracing segmentation, you refine your focus, leading to savvy resource allocation and more nuanced customer engagement strategies. Ultimately, tailored approaches uplift lifetime value, enabling a business to scale intelligently while ensuring each customer feels valued and understood.

Over-reliance on Historical Data

Over-reliance on historical data can steer your CLV initiatives off course, limiting adaptability in a dynamic marketplace. For example, in the fast-evolving e-commerce sector, last year’s high-performing strategies may be this year’s duds.

- Tunnel Vision: Focusing solely on past performance can make you blind to emerging trends and shifts in customer behavior.

- Inaccurate Forecasts: Historical data might not capture seasonality, market disruptions, or shifts in consumer preferences.

- Wasted Investments: Resources deployed based on outdated data often fail to maximize customer value.

Instead, businesses should integrate real-time data analytics and predictive models to continually refresh their CLV calculations. In this way, you can adapt your strategies to meet current customer needs, making your business more agile and better equipped to maximize lifetime value. Thus, you strike a balance between learning from the past and innovating for the future, ensuring each customer interaction remains a step in the right direction.

Not Regularly Updating CLV Calculations

Neglecting to refresh CLV calculations can hamstring a business’s ability to anticipate shifts in customer behavior. Let’s consider the subscription-based industries. If a brand sticks with old metrics, they might not catch wind of a shift in subscription patterns until it’s too late.

- Eroding Insights: Outdated CLV data gradually becomes less reflective of the current customer landscape.

- Missed Revenue Streams: Changes in how customers engage with your product might lead to undiscovered profit opportunities.

- Stagnation in Strategy: Continuous reliance on old data can stymie innovation and growth.

By updating CLV calculations routinely, businesses stay attuned to the heartbeat of their customer base. It’s akin to navigating a ship – adjusting the course based on the most recent star chart ensures you won’t run aground. This consistent recalibration keeps a brand relevant, agile, and squarely in the lane of success.

How to Improve CLV

Boosting CLV goes beyond mere transactional interactions; it’s about elevating every touchpoint in the customer journey. In the retail sector, think tailored promotions and AI-powered recommendation engines:

- Personalize Offers: Leverage data analytics to roll out customized incentives that resonate with individual shopping patterns.

- Post-Purchase Care: Implement follow-up strategies like customer surveys or tailored “how-to” guides to fortify brand affinity.

- Loyalty Programs: Craft engaging rewards systems that make every purchase a step in a longer customer journey.

By optimizing these key areas, a business not only elevates immediate revenue but also amplifies the lifetime value of each customer. It’s the strategy that turns one-time buyers into brand evangelists, cementing long-term success.

Focus on Customer Retention

Putting the spotlight on customer retention pays off in dividends when calculating CLV. Take subscription services for example—companies optimize user dashboards for effortless navigation and pepper in tailor-made recommendations to encourage sustained engagement. Here’s how to amp up retention:

- Harness Feedback Loops: Analyze customer feedback to roll out responsive changes.

- Upsell Strategically: Use behavioral cues to suggest add-ons or premium features.

- Community Building: Invest in forums or social spaces where customers can share experiences and solutions.

By emphasizing retention, a business maximizes lifetime value, converting casual users into dedicated brand enthusiasts. This turns fleeting transactions into perpetual revenue streams, taking CLV metrics from mediocre to monumental.

Upselling and Cross-selling Opportunities

Upselling and cross-selling aren’t just revenue-boosting strategies; they’re the gateway to enriched customer value and lifetime worth. In the SaaS sector, think about how tiered pricing structures entice customers to unlock additional features. Or in fashion retail, how a timely email can spur consumers to snag that matching accessory. Key strategies to focus on:

- Personalized Suggestions: Use data analytics to tailor recommendations.

- Trigger-Based Initiatives: Deploy offers following specific customer actions, like cart abandonment.

- Exclusivity Offers: Create members-only offers to stir up the FOMO effect.

When executed masterfully, these techniques not only boost immediate sales but also stretch the customer’s lifetime arc with your business. Elevating the CLV goes beyond the initial transaction—it requires ongoing, strategic maneuvers to maintain an enduring and profitable relationship.

Delivering Excellent Customer Service

Delivering stellar customer service elevates the customer’s value perception and, consequently, drives up CLV metrics. Take the hotel industry—swift check-in processes and personalized greetings can turn a first-time guest into a lifelong patron. In e-commerce, hassle-free returns and rapid response customer support can distinguish your brand from the sea of competitors. Tips for excellence:

- Speedy Resolutions: Deploy agile support teams that tackle issues before they escalate.

- Predictive Assistance: Use AI to anticipate customer needs and auto-resolve simple queries.

- Personalized Interactions: Leverage CRM data to offer tailored solutions that surprise and delight.

By taking a customer-first approach in your business operations, you not only ensure immediate satisfaction but also set the stage for enduring loyalty. This long-term connection naturally amplifies CLV, making your business more resilient and profitable.

Personalized Marketing Campaigns

Personalized marketing campaigns hold the power to skyrocket CLV by making each customer interaction memorable and impactful. Take the subscription box industry—curating monthly packages based on individual preferences keeps subscribers eagerly anticipating the next delivery. For digital publishers, algorithm-driven reading suggestions hook readers and boost subscription renewals. Strategies to implement:

- Behavior Triggers: Roll out campaigns that respond to specific user actions like abandoned carts or repeat purchases.

- Dynamic Content: Swap out generic banners with real-time offers tailored to the customer’s browsing history.

- Geo-Targeting: Deploy location-based promotions to snag the customer’s attention when they’re most likely to engage.

Executing personalized campaigns takes your business a step further in fostering long-lasting relationships, enriching lifetime value, and driving continual revenue growth.

CLV in the Context of Other Metrics

Navigating the complex landscape of metrics? Place CLV at the helm to steer your business toward profitability. For instance, fashion retailers sync CLV with average order value to optimize inventory decisions. SaaS companies correlate CLV with churn rates to fine-tune their retention strategies. Keep an eye on:

- Acquisition Costs: Lower costs amplify CLV, pushing up profitability.

- Engagement Metrics: High engagement often correlates with increased lifetime value.

- Net Promoter Score: Happy customers usually stick around longer, fortifying CLV.

By harmonizing CLV with other key metrics, businesses master the art of delivering exceptional customer value across the entire lifecycle.

Relationship with Customer Acquisition Cost (CAC)

CLV and Customer Acquisition Cost (CAC) are the dynamic duo steering a business toward long-term gains. Think of it this way: A restaurant invests in high-quality Instagram ads to draw customers. That’s the CAC. When those customers become regulars and spread the word, that’s CLV at work. The interplay between the two is crucial:

- CAC Payback Period: Shorten this span and you’ll juice up CLV.

- LTV-to-CAC Ratio: Aim for an ideal rate of 3:1 to ensure you’re not overspending on acquisition while reaping substantial lifetime value.

- Portfolio Balancing: Luxury car dealerships offset high CAC with stellar after-sales service to boost CLV.

Concentrate on striking a balance between these two financial pillars, and your business will harvest enduring customer value and robust profitability.

CLV and Customer Satisfaction

Customer satisfaction feeds directly into CLV, acting as a performance indicator and growth driver in any business model. Let’s say an online fitness platform consistently surpasses customer expectations with personalized workout plans. Over time, those satisfied customers renew subscriptions, pump up the referral rate, and even opt for premium services. Critical touchpoints include:

- Post-Sale Surveys: Collect data to finetune the customer experience.

- User Experience (UX): Streamline website navigation to cut bounce rates and keep engagement high, similar to how e-commerce giants do it.

- Feedback Loops: Take cues from the airline industry, where frequent flyer programs adapt offers based on customer feedback.

Keep the satisfaction high, and watch your CLV skyrocket—it’s a surefire way to secure long-lasting success and robust business health.

Conclusion

In this comprehensive journey, we’ve unraveled the layers of Customer Lifetime Value (CLV), empowering you with the insights you need to make data-driven decisions that go beyond mere transactions. Whether you’re in ecommerce, the insurance sector, or you’re a small startup, the principles of CLV serve as your compass—guiding your strategies from customer acquisition to upselling.

To encapsulate:

- Understanding CLV provides a strategic edge in optimizing business margins.

- Leveraging tools like HubSpot can crunch your numbers for an accurate LTV calculation.

- CLV goes hand-in-hand with customer experience (CX), from initial contact to lasting loyalty.

For anyone keen to take their CLV and overall business analytics to the next level, don’t hold back. Implement the Plerdy tool for SEO & UX analysis now. This tool not only helps you get valuable insights but also ramps up your site performance, boosting the value you offer to your customers. 🛠️📊

There’s no magic wand for business success, but a grasp of CLV certainly comes close. Let this be your stepping stone to fostering valuable, long-lasting relationships with your customers, bolstering both your bottom line and brand reputation. 🌟 So, if you’re committed to upping your business game, take action today.