Imagine your bank’s digital marketing strategy is like trying to flirt in a crowded, noisy room. You want to stand out and be heard over everyone else. Well, that’s where we come in. In this bustling world of digital finance, grabbing your audience’s attention isn’t just about being louder; it’s about being smarter. Here at Plerdy, we know something about catching the eye of the digital crowd. This article dives into seven strategies that make your bank’s digital marketing as compelling as getting that coveted swipe in finance. Let’s get noticed.

Revolutionizing Marketing in Banking: Harnessing the Power of Personalization for Enhanced Digital Engagements

Have you ever felt uniquely recognized when a service seems to understand your preferences as if by magic? This is the cornerstone of modern digital marketing strategies in the banking sector. Nowadays, it’s not merely about providing financial services but about customizing them to align seamlessly with each customer’s needs.

The Critical Role of Personalization in Banking Marketing

While personalization in banking marketing has been around for some time, its implementation in the digital sphere is groundbreaking. Through meticulous customer data analysis, banks can now present offers and services that resonate on a personal level with each customer. This approach transcends conventional customer service; it’s a strategic marketing move. Research conducted by Epsilon indicates that a staggering 80% of customers gravitate towards businesses that deliver personalized experiences.

Elevating Customer Engagement with AI in Bank Marketing

Integrating Artificial Intelligence (AI) in bank marketing propels personalization to new heights. AI’s predictive capabilities can forecast a customer’s future actions, provide bespoke financial advice according to spending patterns, or preemptively detect potential fraud risks. AI’s prowess extends beyond understanding customer desires; it anticipates their needs. For example, AI enhances bank marketing efforts by automating customized communications, recommending financial strategies based on user activity, and bolstering security measures. This ensures that digital banking services are more personalized and significantly safer.

Personalization’s Impact on Digital Banking and Marketing

The essence of personalization in digital bank marketing lies beyond merely boosting service sales; it fosters a deep-seated connection with the customer base. Banks that excel in customizing their digital marketing strategies are perceived as financial vendors and dependable financial allies. In today’s digital era, a personalized marketing approach can transform a single transaction into a durable bond. This shift redefines the core of banking marketing, emphasizing the transformative power of personalized digital marketing strategies in banking. For those interested in further exploring how personalization is redefining customer expectations and behaviors in banking, Epsilon’s recent findings provide extensive insights into the evolving landscape of bank marketing.

Elevating Bank Marketing Visibility: Essential SEO and Mobile Optimization Techniques for Digital Banking

In today’s digital-first landscape, where a quick Google search is the gateway to discovery, a bank’s online invisibility equates to operating in the shadows. For banks, obscurity online means missing out on crucial customer engagement opportunities. However, leveraging SEO and mobile optimization strategies can illuminate the path to prominence.

SEO’s Role in Bank Marketing

SEO is the beacon directing prospective clients to your bank’s digital doorstep. Incorporating banking-specific keywords into your content ensures that your bank ranks higher in search engine results, enhancing your visibility to those seeking financial services. However, the efficacy of SEO in bank marketing extends beyond mere keywords. The architecture of your site, loading speed, and security protocols are pivotal in boosting your search engine rankings, as highlighted by SEO authority Moz. These elements collectively enhance your bank’s digital footprint.

The Imperative of Mobile Optimization in Banking

As mobile devices become the primary internet access, a bank’s digital platform must excel on smaller screens. Mobile optimization is not just an enhancement; it’s a necessity for banks. A mobile-friendly banking website offers optimal viewing and interaction experience across all devices, crucial for retaining visitor interest and engagement. This strategy is about ensuring swift load times, streamlined navigation, and overall site responsiveness, which are vital for keeping potential customers engaged with your bank’s offerings.

SEO and mobile optimization are not mere trends but foundational elements of effective digital bank marketing. These strategies ensure that your bank remains visible to potential customers during their search process and accessible upon their decision to engage further. These marketing methods are essential for banks looking to grow their online presence, customer base, and digital competitiveness. For actionable insights and assessments, starting with Google’s Mobile-Friendly Test can provide banks with a clear evaluation of their website’s mobile optimization status, setting the stage for enhanced digital marketing effectiveness.

Building Connections: How Banks Can Enhance Digital Marketing through Social Media

Ever scrolled through your social media feed and spotted a bank that feels more like a friend than a financial institution? That’s social media magic at work. For banks, the digital age is not just about transactions; it’s about conversations. Engaging with customers on social media isn’t an option anymore; it’s a necessity.

Building a Social Media Presence

Crafting a social media presence goes beyond posting regularly. It is about audience-relevant content. This means sharing financial tips, community news, or even behind-the-scenes looks into your bank’s culture. It’s about being relatable and accessible. Social media humanizes and builds trust in your brand.

Engaging with Your Audience

Engagement is the currency of social media. Responding to comments, participating in discussions, and hosting live Q&A sessions can transform your bank from a faceless entity into a trusted friend. Remember, engagement shouldn’t be seen as a task but as an opportunity to listen and learn from your customers.

Social media builds relationships, not just marketing. For banks willing to invest the time and effort, it provides information, builds loyalty, and improves brand image directly to customers. In today’s digital age, a strong social media presence is invaluable. It turns your bank into a community member, not just a place to store money. For more insights into building a strong social media strategy, resources like HubSpot’s Social Media Marketing Guide offer comprehensive tips and strategies.

Engaging Customers: The Role of Content Marketing in Digital Banking Strategies

In a world where attention is the new currency, your content either captivates or evaporates. For banks, content marketing is not just about broadcasting services; it’s about providing value, educating, and engaging customers beyond the transactional relationship. It’s what turns viewers into loyal customers.

Types of Content Marketing

Content marketing in the banking sector can take many forms – from blog posts offering financial advice to videos explaining complex financial products in simple terms. Infographics can break down investment strategies, while eBooks can guide first-time homebuyers through purchasing. The key is to provide content that helps, educates, and entertains, making financial matters less intimidating and more accessible.

Content Strategy and Distribution

Crafting content is only half the battle; the other half is getting it in front of the right eyes. A solid distribution strategy ensures your content reaches your target audience through the right channels, whether social media, email newsletters, or your bank’s website. Analytics play a crucial role here, helping to refine your strategy by understanding what resonates with your audience and why.

Content marketing in digital banking may deepen consumer engagement and turn transactions into interactions. It’s about creating a voice for your bank that advises guides. It reassures your customers, making your bank a financial institution and a trusted advisor in their financial journey. Banks that master this art will attract and retain customers in the digital age, where loyalty is as scarce as it is precious. For a deeper dive into developing a content strategy, resources like Content Marketing Institute offer invaluable insights and guidance.

Direct Impact: Elevating Bank Marketing with Targeted Email Campaigns in the Digital Age

In an era where our inboxes are gateways to our attention, targeted email campaigns are the key to unlocking a deeper connection with customers. For banks, email isn’t just about communication; it’s a precision tool for creating relevance in a sea of digital noise. Tailored email campaigns can transform how customers perceive and interact with their financial institutions.

Email Marketing Best Practices

Crafting emails that resonate means going beyond the generic. Personalization based on consumer behavior and preferences can boost openness and engagement. Segmentation allows banks to send relevant information to specific groups, ensuring that content is seen and meaningful. According to Campaign Monitor, personalized emails deliver six times higher transaction rates, underscoring the importance of customization in your campaigns.

Automation and Personalization Bank Marketing

Leveraging automation tools can help banks send timely, relevant messages without the constant manual effort. Automated workflows might send welcome emails following account creation or reminders for unfinished applications. This level of personalization makes customers feel understood and valued, enhancing their overall experience with your bank.

Targeted email campaigns are more than just a method of communication; they are an opportunity for banks to build loyalty, trust, and a sense of personal connection with their customers. The direct impact of well-executed email marketing can elevate a bank’s marketing strategy from good to great, making it an indispensable tool in the digital age. For banks ready to take their email campaigns to the next level, exploring resources like Mailchimp’s guide to email marketing can provide both inspiration and practical advice.

Revolutionizing Banking Marketing: The Impact of Chatbots on Digital Customer Engagement

Chatbots have redefined customer service parameters within digital banking marketing, offering a seamless service experience beyond conventional banking hours. This 24/7 accessibility ensures that customers can receive assistance from straightforward account questions to complex loan application inquiries anytime, significantly enhancing customer satisfaction and fostering loyalty through marketing efforts.

The role of chatbots in marketing extends to more sophisticated interactions than basic queries. Advanced AI allows modern chatbots to comprehend and process intricate customer requests. This includes executing transactions, offering tailored financial guidance based on individual spending patterns and objectives, and alerting customers about potential fraud risks. Such proactive marketing strategies secure customer trust and reinforce the bank’s reputation as a proactive and attentive financial advisor.

Marketing Success with Chatbot Integration

Leading banks have harnessed the power of chatbots to boost their marketing and customer service capabilities. Bank of America’s Erica is a stellar example, enabling users to manage their accounts effortlessly, track spending, and promptly access financial advice. Erica exemplifies the future of digital banking marketing tools, turning routine transactions into engaging customer experiences.

JPMorgan Chase’s utilization of chatbots to enhance internal efficiencies further illustrates the marketing value of these technologies. By delegating routine tasks to chatbots, human employees can dedicate more time to complex, high-value customer interactions, enhancing marketing impact and operational efficiency.

The Future of Banking Marketing

Integrating chatbots into digital banking strategies signifies a major leap towards more dynamic and interactive customer service methodologies. Chatbots combine efficiency with a personalized approach, establishing a new benchmark for customer engagement in the banking sector. As chatbot technology evolves, we anticipate expanding its capabilities, including predictive analytics for customized product suggestions and deeper integration into customers’ financial lives, marking a significant trend in banking marketing strategies.

For banks that have yet to embrace chatbot technology, the direction is clear: the future of banking marketing is digital, highly interactive, and centered on customer needs. Adopting chatbots goes beyond following digital trends; it involves reimagining the banking experience to surpass the changing expectations of modern customers.

For those keen on exploring the role of chatbots in banking marketing further, resources like Forbes’ insights into AI and chatbots in the banking sector provide comprehensive analysis on how these digital aids are shaping the future of the industry. By staying informed and flexible, banks can maintain their competitive edge in the digital era, offering marketing and services that are convenient and deeply aligned with customer preferences.

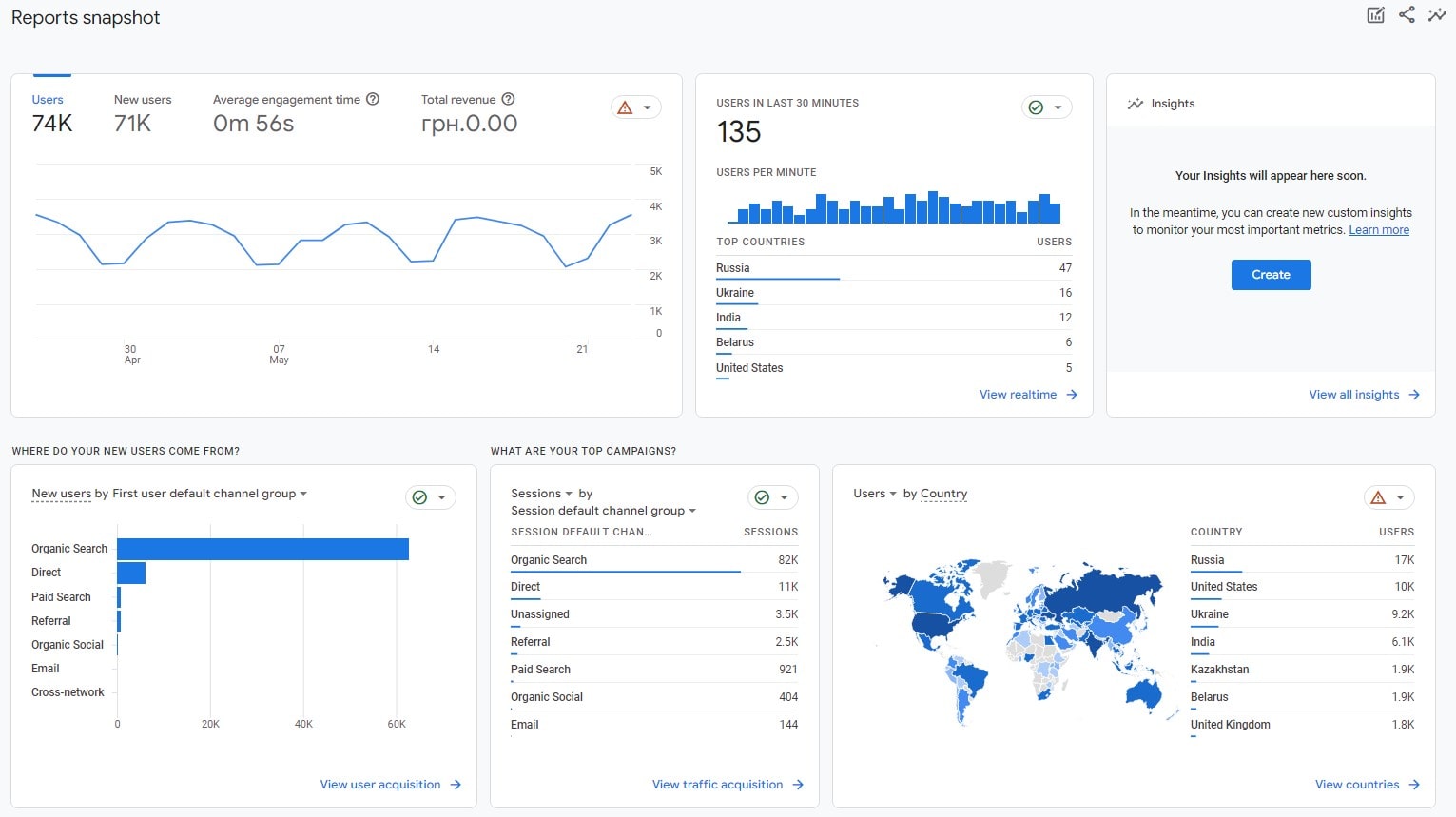

Strategic Insights: Leveraging Data-Driven Decision Making in Bank Digital Marketing

In a world where every click, view, and swipe holds valuable insights, banks sitting on data goldmines are the new kings. But it’s not just about collecting data; it’s about making sense of it all. Data-driven decision-making in bank digital marketing isn’t just smart; it’s essential for staying ahead in the competitive financial landscape.

Utilizing Analytics in Marketing

Analytics turn raw data into strategic insights, helping banks understand customer behaviors, preferences, and pain points. This understanding enables targeted marketing efforts that resonate with customers, improve engagement, and increase conversion rates. By analyzing trends and patterns, banks can tailor their offerings, ensuring that the right message reaches the right customer at the right time.

Case Studies in Data-Driven Marketing

Many banks have already seen significant benefits from implementing data-driven strategies. For example, JPMorgan Chase used data analytics to revamp its digital marketing campaigns, resulting in a 20% increase in conversion rates. These successes underline the transformative power of data in crafting marketing strategies that are not only effective but also efficient.

Success in bank digital marketing requires data-driven decision-making. It allows banks to navigate the digital realm precisely, making every marketing dollar count. As the financial industry continues to evolve, the ability to harness data will distinguish the leaders from the followers. For those ready to dive deeper into data-driven marketing, resources like McKinsey’s insights on digital banking offer invaluable guidance and inspiration.

Conclusion

In the digital era, banks must evolve or risk being left behind. The strategies discussed offer a roadmap to revolutionize how banks interact with their customers, turning digital channels into powerful tools for engagement and service. Banks can meet and exceed customer expectations by embracing personalization, optimizing for mobile, leveraging social media, and making data-driven decisions. The future of banking isn’t just digital; it’s highly personalized, interactive, and customer-focused. Interested in more insights like these? Dive into other articles on Plerdy’s blog to keep your marketing strategies sharp and ahead of the curve. Explore Plerdy today to unlock the full potential of your digital marketing efforts.